FEDERAL BUDGET 2023-24

Download Pdf version of Budget 2023-24

The government of Pakistan presented budget for fiscal year 2023-24 on Friday. Business Recorder takes a look at some of the key highlights of the documents.

o Economic growth target fixed at 3.5% for fiscal year 2023-24

o Inflation forecasted to average at 21%

o Tax-to-GDP ratio to stand at 8.7%

o Current account deficit to stand at $6 billion by end of fiscal year 2023-24

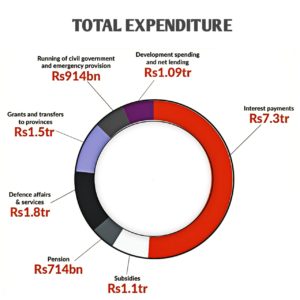

o Government has allocated Rs1.8 trillion for defense spending

o Rs1.1 trillion earmarked for subsidies

o Rs761 billion allocated for pension

o Government will spend Rs950 billion on account of Public Sector Development Programme

o Rs10 billion earmarked for PM’s Youth Business and Agriculture Loans scheme

o Rs6 billion subsidy announced on imported urea

o Targeted subsidy announced on wheat flour, ghee, pulses and rice

o 35% increase in salaries of government servants of grade 1-16 in the form of ad-hoc relief

o 30% increase in salaries of government servants of grade 17-22 in the form of ad-hoc relief

o Tax free imports of software and hardware by IT and IT enabled services equal to 1% of their exports with a ceiling of $50,000

o No sales tax return by freelancers with exports of $2,000 per month

o Increase in Benazir Income Support Programme allocation from Rs400 billion to Rs450 billion

o Upward revision in pensions and increase in minimum pension to Rs12,000

o Rs10 billion set aside for provisions of 100,000 laptops for students

o Exemption of custom duty on import of raw material for batteries, solar panels and inverters

o Rs22.7 billion earmarked for health sector

o Agriculture credit limit enhanced from Rs1,800 billion to Rs2,250 billion

o Solarization of 50,000 agriculture tube wells through Rs30 billion

o Withdrawal of all duties and taxes on imported seeds, combined harvesters, dryers and rice planters